Focusing on our goals and dreams gives us a sense of purpose and investing in mutual funds is a way to plan for these goals. Investments in mutual funds should be done with a specific financial goal in mind. For example, a retirement that is twenty years away or a higher education fund of a child that is ten years away. It is in times like these, that we have to remind ourselves of these goals and their importance. We should not let market volatility come in the way of our plans for ourselves and our loved ones. These goals give us hope in tough times like these and hold the promise of a better future. Hence, it is very important to focus on our goals.

Stay invested

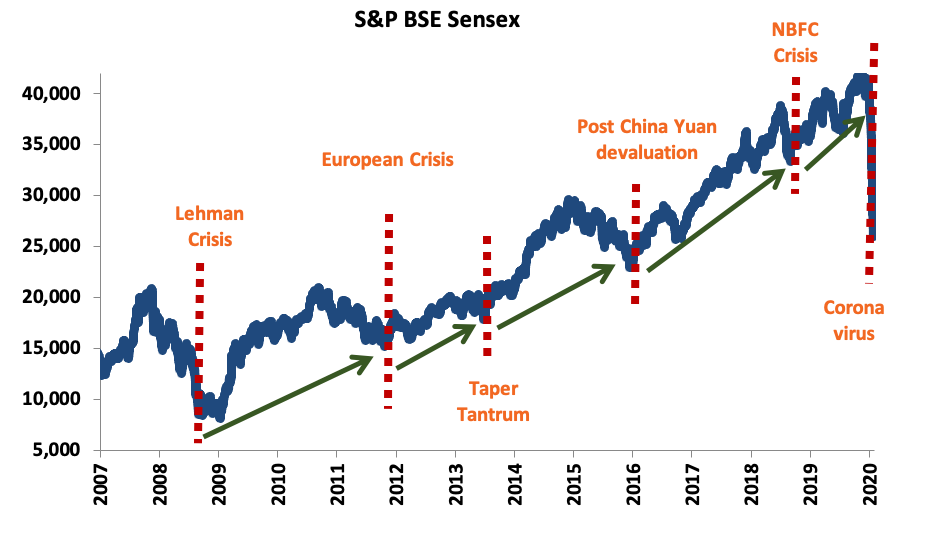

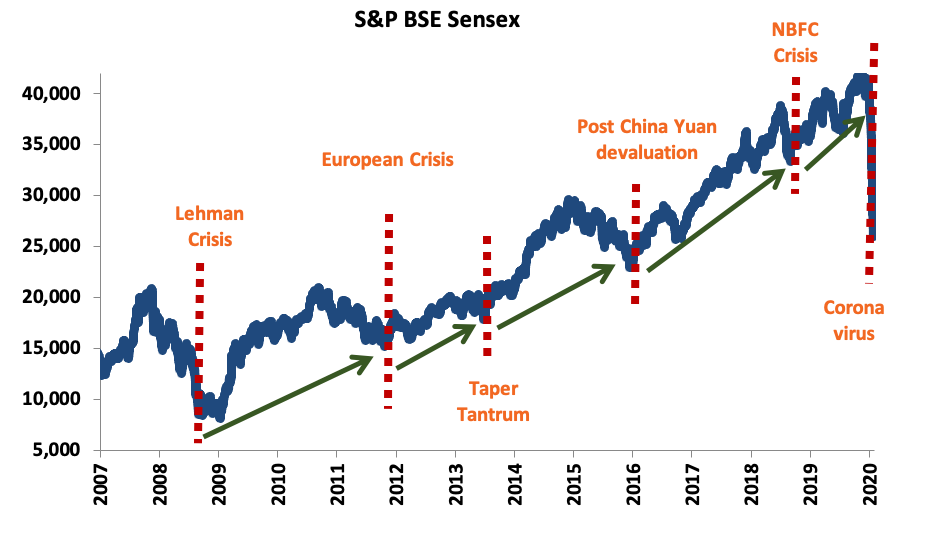

In tough times like these, you need to remind yourself about why you invested. If your long term goals haven’t changed then why change the plans to achieve them. It is also important to remember that historically, despite short term volatility, equity markets have created wealth for investors over the long term as seen in the chart below. From 2008 to 2020, multiple crises caused the markets to fall multiple times but markets have usually bounced back. Through the constant volatility over a decade, the Sensex nevertheless rose, creating wealth for investors who stayed invested for the long term.

Year | 2008 to 2009 | 2011 to 2012 | 2013 to 2014 | Feb-16 to Nov-16* | 2018 to 2019 |

1 Year Returns | 101% | 28% | 43% | 16% | 13% |

Source: MFI. Data as of March 31 2020. Past performance may or may not sustain in future. *All returns mentioned are 1Y returns except for Feb-16 to Nov-16. For 2008 to 2009, Period considered is 20-Nov-08 to 20-Nov-09, For 2011 to 2012, Period considered is 20-Dec-11 to 20-Dec-12, For 2013 to 2014, Period considered is 31-Aug-13 to 31-Aug-14. For 2018 to 2019, Period considered is 30-Nov-18 to 31-Dec-19. Returns are in absolute terms except for the period 2018 to 2019 which are CAGR returns

Continue your SIPs

We all know that investing systematically builds in the discipline of investing and is an easy and simple way to plan your goals. But the biggest benefit of investing through a SIP is to get the benefit of rupee cost averaging. SIPs work best when the markets are volatile. When the markets are high, you get fewer units of your mutual funds through SIPs. When the markets are down, you get more units for the same amount. This averages out the investment cost over time. We need to keep in mind that markets never move in straight lines. Hence, the current market fall can be looked as an opportunity and we can take advantage of it by continuing or enhancing your SIPs to truly benefit from rupee cost averaging.

Don’t try to time the market

Rather than trying to time the market, it is important for investors to remain focused on their long-term goals and create appropriate asset allocation strategies to achieve them. If you stop investing when the markets are low, you may end up missing out on any potential upswing as well. You may end up losing an opportunity to benefit when the markets eventually rise up.

Look Beyond the Short Term

While it may be tempting for investors to think they know where the market is headed, however making changes or discontinuing investments in mutual funds can be counterproductive in the long run. Making financial decisions based on emotional responses can lead investors astray, locking in losses, or missing out on potential gains. Whether in good times or bad, it is always important to keep a long-term view on investments. A long-term focus will help create wealth over time.

Keep Dreaming and Stay invested in Mutual Funds for the long term.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

![]()

![]()

![]()

![]()